Orange County Bancorp, Inc. Announces First Quarter Results

- Total Q1 revenues increased 12.2% year-over-year to $14.1 million

- Quarterly Net Income declined 16.5% to $2.4 million from the prior quarter due to a $665 thousand, or 124%, increase in provisions for loan losses

- Tangible Book Value per Share of $26.45 up 15.0% from same period last year

- Total Assets up 19.8% versus same period last year to $1.36 billion

- Average Demand Deposits up 29.9% year-over-year to $345.1 million

- Average Loans up 20.5% year-over-year to $915.1 million

MIDDLETOWN, N.Y., APRIL 27, 2020 – Orange County Bancorp, Inc. (the “Company” – OTCQX: OCBI), parent of Orange Bank & Trust Co. (the “Bank”) and Hudson Valley Investment Advisors, Inc. (HVIA), today announced net income of $2.4 million, or $0.54 per share, for the three months ended March 31, 2020. This compares with net income of $2.9 million, or $0.65 per share, for the three months ended December 31, 2019 and $2.2 million, or $0.50 per share, for the three months ended March 31, 2019.

“While I am pleased with the Bank’s results for the quarter, the economic hardship and concerns our customers and the community are experiencing as a result of the COVID-19 shutdown dulls any sense of celebration.” said Michael Gilfeather, President and Chief Executive Officer. “In my opinion, the most remarkable thing about the quarter, though strong financially, was the commitment of our team to help clients effectively manage these challenging circumstances.

Our earnings for the first quarter reflected the same momentum with which we ended 2019. Despite increasing loan loss reserves 124%, to $1.2 million, as a precautionary step due to potential impacts of COVID-19, we earned $2.4 million for the quarter, maintained strong capital levels, and ended the quarter with increased liquidity. These results reflect the strength of our balance sheet, diversity of earnings, and resilience of our bankers in serving clients despite the challenges of the health crisis. Had we not taken the prudent step of bolstering reserves, despite solid performance of our loan portfolio to date, we would have reported yet another record earnings quarter.

The performance was even more remarkable given our decision to participate in the federal Paycheck Protection Program (PPP), which was established late in the quarter to help small to midsize businesses retain employees during the economic shutdown. The program required us to quickly implement efforts to help small business clients with the loan application process. Though policies, rules and guidance for participation continued to evolve during the process, we were able to approve and fund 270 applications totaling in excess of $40 million, benefiting clients and their employees. We have continued to work with clients who missed the initial round of funding and have a number of applications in queue for the additional contribution approved by Congress.

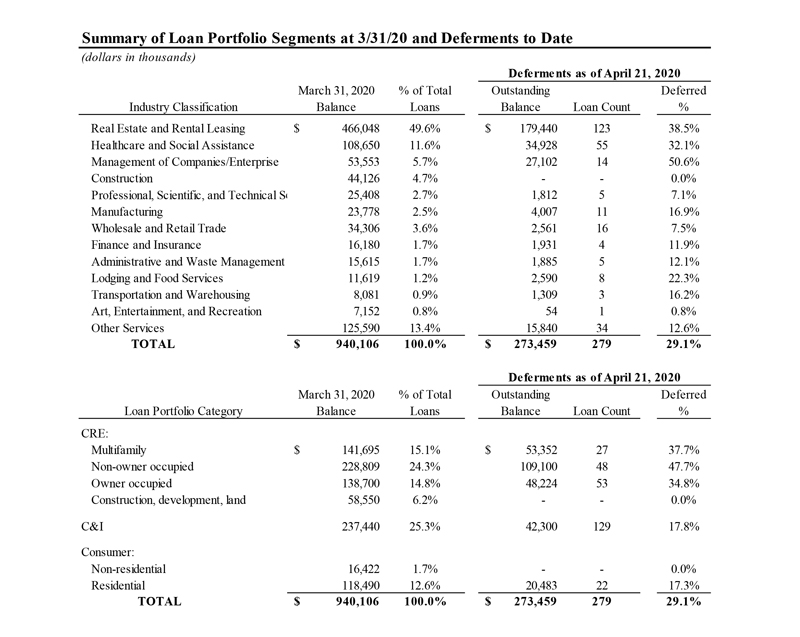

We are also working with loan customers adversely affected by the shutdown to defer payments of interest and principal for 90 days to reduce the financial pressure created by this unprecedented crisis. Through April 21st, we have 279 requests for payment deferrals on approximately $273 million of loans.

As we work through the presence and impacts of COVID-19, the Bank has continued to adapt and provide services in this fast-changing environment. I am extremely proud of how our staff has responded despite the challenges of social distancing, the state/county lockdown, and telecommuting. I am further reassured by the unity and acts of selflessness we witness in our community every day, and confident we will come through this strengthened by the experience. While we had an exceptional first quarter, it is difficult to know if we will be able to maintain this momentum in the event of a prolonged shutdown. But as an essential business in the communities we serve, we remain open and committed to providing superior service to our clients, safe, flexible work places for our employees, and outstanding results for our shareholders.”

Income Statement Summary

Net interest income for the three months ended March 31, 2020 increased $1.3 million, or 12.8%, to $11.4 million, compared with the three months ended March 31, 2019. The increase is primarily due to a $187.5 million, or 18.0%, increase in average interest earning assets. The growth in earning assets more than offset the 13bp decline in average earning rates, which reflect today’s historically low interest rate environment. The increase in average interest earning assets was driven primarily by a $155.6 million, or 19.6%, increase in average loans outstanding. Net interest margin of 3.74% for the three months ended March 31, 2020 represents a 21 basis point, or 5.3%, decline versus 3.95% for the same period last year. The average cost of interest-bearing deposits for the three months ended March 31, 2020 was 0.63%, compared to 0.49% for the three months ended March 31, 2019, an increase of 14 basis points, or 28.6%. For the Bank and industry as a whole, 2019 was a period of increasing funding costs consistent with higher market interest rates during the year. The rate picture changed dramatically in late March, 2020, when the Bank began to reduce its deposit costs, as evidenced by a 7bp decline in cost of funds compared to the prior quarter. Because these rate reductions began late in the quarter, their impacts will manifest themselves more in coming quarters. Cost of funds also benefited from continued strong growth in non-interest bearing demand accounts, with a $79.3 million, or 29.9%, increase to an average of $345.1 million versus March 31, 2019.

The bank’s provision for loan losses was $1.2 million for the three months ended March 31, 2020, compared to $535 thousand the prior quarter, and $600 thousand for the three months ended March 31, 2019. The increase was taken in response to uncertainty surrounding loan performance due to the COVID-19 related shutdown of various business sectors. Non-accrual loans, as a percent of total loans, was 0.17% as of March 31, 2020, same as the period ended December 31, 2019, and a 0.05% decrease from the period ended March 31, 2019. See the asset quality section below for additional information.

Non-interest income decreased $15 thousand, to $2.7 million, for the three months ended March 31, 2020, compared to the three months ended December 31, 2019, and increased $244 thousand versus the three months ended March 31, 2019. The quarter over quarter decline was due primarily to lower investment management income resulting from lower stock values at quarter end. The year-over-year increase includes $137 thousand of realized losses on securities sales during the three months ended March 31, 2019.

Non-interest expense increased $78 thousand, to $9.9 million, for the three months ended March 31, 2020, compared to the three months ended December 31, 2019, and $672 thousand compared to the quarter ending March 31, 2019. The year-over-year increase was due primarily to a $275 thousand increase in salaries and employee benefits resulting from growth-related staffing.

The Company’s effective income tax rate for the three months ended March 31, 2020 was 20.2%. This compares with 20.6% for the three months ended December 31, 2019, and 19.6% for the three months ended March 31, 2019.

Balance Sheet Summary

Total assets increased $224 million, or 19.8%, to $1.36 billion at March 31, 2020 from $1.13 billion at March 31, 2019. This was primarily comprised of increases of: $161.2 million in loans, $35.4 million in cash and cash equivalents, and $22.0 million in investment securities. The year-over-year increase in cash and cash equivalents was primarily due to increases in deposits, while the increase in loans was the result of $252.0 million of new loan originations and $33.4 million in purchases, partially offset by $124.4 million of net amortization and repayments on our existing portfolio. For the quarter ended March 31, 2020, new loan originations totaled $55.2 million, draws on credit lines totaled $11.9 million and loan purchases were $21.2 million, partially offset by net amortization and loan repayments of $40.5 million.

Total liabilities increased $208.6 million, to $1.2 billion, at March 31, 2020 from $1.0 billion at March 31, 2019. This was due to a $215.2 million, or 21.6%, increase in total deposits partially offset by a $10 million reduction in FHLB advances.

The quarter saw continuation of deposit growth from non-interest-bearing commercial demand deposits (“DDA”) and NOW accounts. Growth in these deposits was $70.4 million, or 25.0%, for the one year period consistent with the Bank’s strategy to grow value added business deposits with the support of advanced cash management services. Commercial deposits were 49.3% of total deposits at March 31, 2020, compared to 46.8% at March 31, 2019. This increase reflects strong response to our company-wide focus on business relationships. Total DDA and NOW balances were 46.6% of total deposits at March 31, 2020.

Total shareholders’ equity increased $15.2 million, or 13.7%, to $126.3 million at March 31, 2020, from $111.1 million at March 31, 2019. This increase was due to a $7.7 million increase in retained earnings and a $7.4 million improvement in the market value of securities available for sale.

At March 31, 2020, the Company’s book value per common share and tangible book value per common share were $28.13 and $26.45, respectively, compared to $24.75 and $23.00, respectively, at March 31, 2019. This represents increases of 13.6% and 15.0%, respectively. At March 31, 2020, the Bank exceeded the “well capitalized” thresholds under applicable regulatory guidelines.

Asset Quality Summary

Non-performing loans increased to $1.59 million, or 0.17%, of total loans as of March 31, 2020, from $1.55 million, or 0.17%, of total loans as of December 31, 2019. Non-performing loans decreased $82 thousand, from $1.67 million or 0.22% of total loans as of March 31, 2019.

Loans classified as substandard or doubtful increased $504 thousand, or 3.6%, to $14.5 million at March 31, 2020 from $14.0 million at December 31, 2019, and decreased $351 thousand, or 2.4%, from $14.9 million at March 31, 2019. Watch rated loans decreased $1.1 million, or 9.8%, to $10.1 million at March 31, 2020 from $11.2 million at December 31, 2019. Delinquencies (inclusive of loans on non-accrual) increased to $13.4 million, or 1.42%, of total loans at March 31, 2020, from $8.2 million, or 0.92%, of total loans at December 31, 2019, and increased $9.8 million from $3.6 million, or 0.47%, of total loans at March 31, 2019. The increase in delinquencies for the most recent quarter, relative to the quarter ended December 31, 2019, was concentrated in accounts 30-59 days past due, reflecting a small number of lending relationships brought current subsequent to quarter end through scheduled payments (totaling $5.6 million) or approved short-term deferments of principal and interest payments (totaling $1.3 million). The Bank is working proactively with customers to manage COVID-19 related forbearance requests, where necessary, with a view toward mitigating increases to reported near-term delinquencies through these efforts.

In response to the observed and anticipated economic impact of COVID-19, management has identified several asset categories and industry classifications deemed to be higher risk, and initiated active steps with customers to evaluate cash flows and, if necessary, provide payment relief from debt service obligations. This relief has been structured as 90-day deferments of principal and interest and effected broadly across the portfolio based on our analysis and direct feedback from customers. The composition of the Bank’s loan portfolio spans commercial real estate loans (“CRE”), commercial and industrial loans (“C&I”), and consumer loans. Concentrations across asset classes and industries with associated deferments processed and in process through April 21, 2020 are as follows:

At the outset of the pandemic, management identified certain industries, including hospitality, healthcare, and retail, believed to be at high risk and most susceptible to stress from a prolonged economic slowdown. Notwithstanding perceived industry risks, portfolio concentration and exposure across these segments is modest. Notably, Lodging and Food Services, which broadly reflects exposure to hotels, food and beverage, constitutes just $11.6MM of exposure or 1.2% of our total loan portfolio. Within this segment, payment deferrals have been processed for approximately 22.3% of total exposure.

CRE, representing 60.4% of the total loan portfolio on a collective basis, represents the largest asset class within the portfolio and has experienced the greatest concentration of payment deferments to date. This trend is consistent with management’s expectations, although the CRE portfolio continues to demonstrate strong equity values on a loan level basis, the impact on cash flow from business closures would have a meaningful near-term impact on the cash available for debt service of investment properties. Given expectations for continued tenant demand across the Bank’s geographic footprint, we expect cash flows to revert to normalized levels over the intermediate term.

At March 31, 2020, the Company’s allowance for loan losses was 1.44% of total loans outstanding, an increase from 1.37% at December 31, 2019, and down from 1.47% at March 31, 2019. Uncertainties about the current credit environment prompted an increase in the reserve ratio during the most recent quarter. The Bank has historically maintained a high ratio of loan loss allowances relative to its peers, and will continue to prudently manage reserves through close monitoring of business conditions and high risk industries and thorough analysis of the profitability and cash flow of loan customers.

Trust and Advisory Summary

Our Trust and Asset Management businesses performed well during the quarter, increasing fee related revenue 6.4% compared to the same period last year. These businesses were able to show a 1% increase in fee revenue over the most recent quarter despite a material decline in equity values. Combined, these businesses attracted new assets under management of over $18 million in the most recent quarter. Close relationships and continuous outreach to our Trust and Asset Management customers provided valued support during this time of uncertainty and the nearly 20% decline in equity prices.

About Orange County Bancorp, Inc.

Orange County Bancorp, Inc. is the parent company of Orange Bank & Trust Company and Hudson Valley Investment Advisors, Inc. Orange Bank & Trust Company is an independent bank that began with the vision of 14 founders over 125 years ago. It has grown through conservative banking practices, ongoing innovation and an unwavering commitment to its community and business clientele to more than $1.3 billion in Total Assets. In recent years, Orange Bank & Trust Company has added branches in Rockland and Westchester Counties. Hudson Valley Investment Advisors, Inc. is a Registered Investment Advisor in Goshen, NY. It was founded in 1996 and was acquired by the Company in 2012. For more information, visit orangebanktrust.com or hviaonline.com

For further information:

Robert L. Peacock

EVP Chief Financial Officer

Phone: (845) 341-5005