Orange County Bancorp, Inc. Announces Second Quarter and Year-to-Date Results through June 30, 2020

MIDDLETOWN, N.Y., JULY 27, 2020 – Orange County Bancorp, Inc. (the “Company” – OTCQX: OCBI), parent of Orange Bank & Trust Co. (the “Bank”) and Hudson Valley Investment Advisors, Inc. (HVIA), today announced net income of $2.7 million, or $0.61 per share, and $5.2 million, or $1.15 per share, for the three and six months ended June 30, 2020, respectively. This compares with net income of $2.8 million, or $0.63 per share, and $5.0 million, or $1.12 per share, for the three and six months ended June 30, 2019, respectively.

- Net Interest Income for the first half of 2020 was $23.3 million, up 12.4% over last year and for the second quarter of 2020 was $11.8 million, up 12.1% over the same period last year

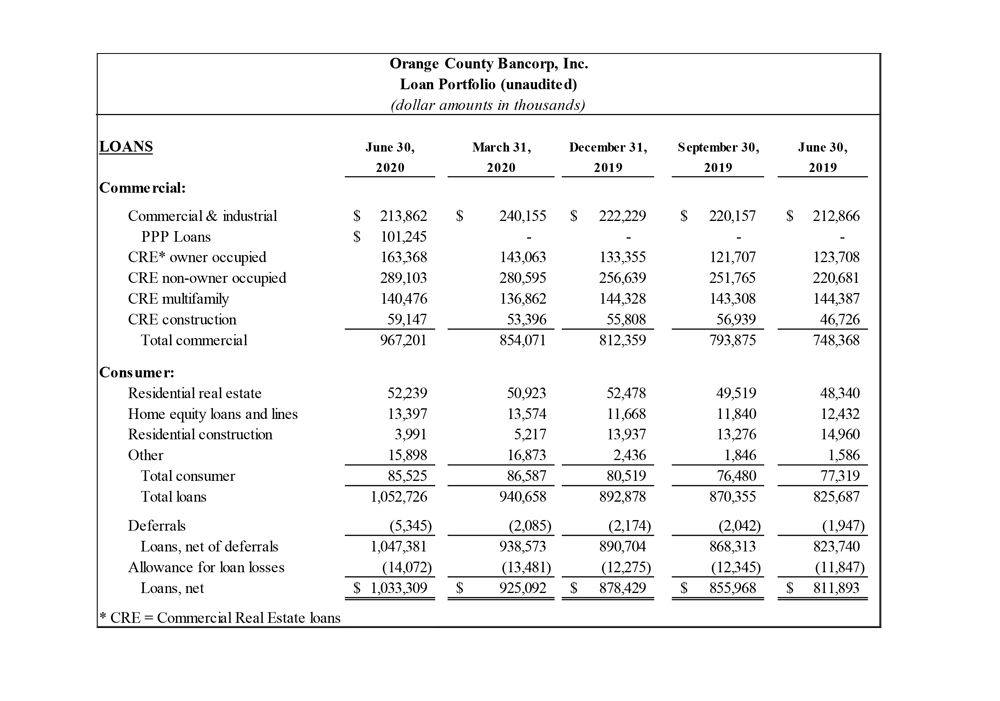

- Average loans for the second quarter of 2020 was $1.01 billion, up 26% over same quarter last year, including PPP loans

- Average Non-Interest Bearing Deposits for the first half of 2020 were $401.0 million, up 20.4%, including undrawn PPP loan balances.

- Provisions for loan losses for the first half of 2020 were $2.5 million, up $1.5 million from $1.0 million last year

- Total Assets increased 28.8% from December 31, 2019 to $1.58 billion

Tangible Book Value per Share of $27.02 increased 6.8% from December 31, 2019 “I am very pleased with the Bank’s performance in the second quarter given the enormous challenges the state-mandated shut down placed on the regional economy and every facet of our business,” said Michael Gilfeather, President and Chief Executive Officer. “Earnings were strong, and loans, and demand deposits all grew quarter-over-quarter, with our success helping business clients access more than $100 million through over 800 loans under the Federal Payroll Protection Program playing a significant role. More important than the numbers, however, was the performance of our employees and the advantages exhibited by our community-based, customer-centric business model, which enabled us to deliver tailored service and value to our clients throughout this turbulent period. We also remain on the lookout for new locations to leverage our unique offering, and I am happy to report the recent approval of two new branches in the Bronx and Nanuet, which are scheduled to open in the next 6 to 9 months.

In addition to helping grow loans and deposits, relationship banking also provides us better insight into management of our loan portfolio, which we are also applying to deferrals resulting from the COVID-19 health crisis. Though we have very limited exposure to higher risk industries like leisure, entertainment and retail, our business clients have certainly not been immune to the economic slowdown. Our response has been to approach them directly to understand their needs and constraints, provide short-term deferment from loan obligations, where appropriate or necessary, and monitor their recovery as the region works through its phased reopening. Given the risk some of these businesses may never recover fully, we, like banks across the US, have also prudently increased our provision for loan losses.

I am proud of the bank’s results through the first half of 2020 and believe the systems and strategies we have in place will help us manage the unprecedented uncertainties caused by the economic shutdown,” Gilfeather continued. “Though local economies are just seeing benefits from re-opening, we are keenly aware this could change quickly and adversely impact the recovery. I am confident we can meet such difficulties with our employees’ dedication to and knowledge of our customers, the breadth of services we provide, and high lending standards we employ. By maintaining a focus on these strengths, we will continue to deliver the superior results our customers and shareholders expect.”

Income Statement Summary

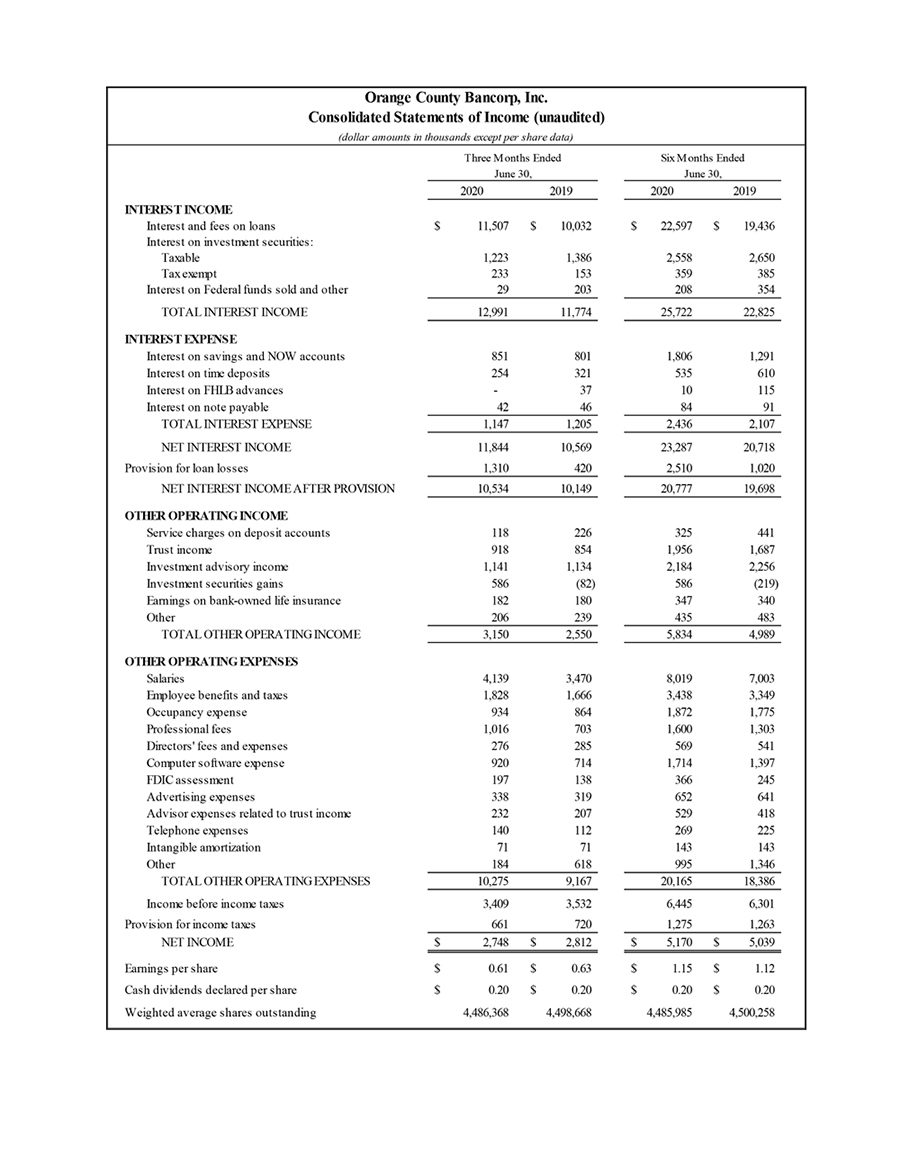

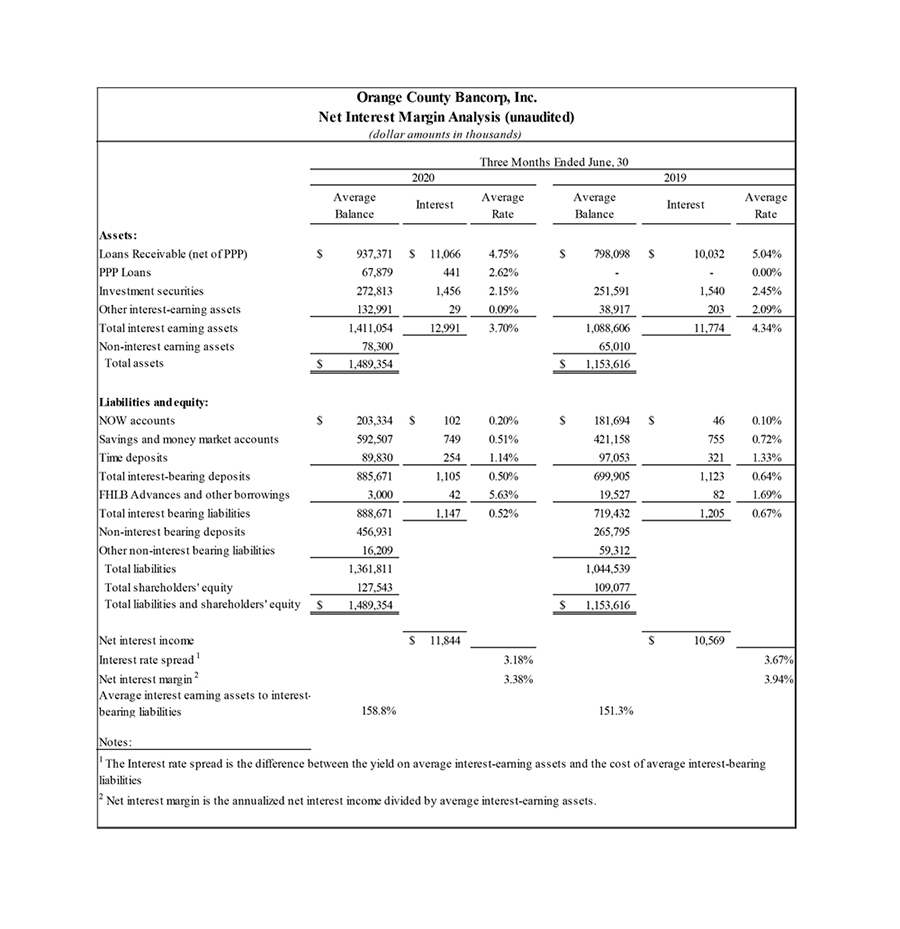

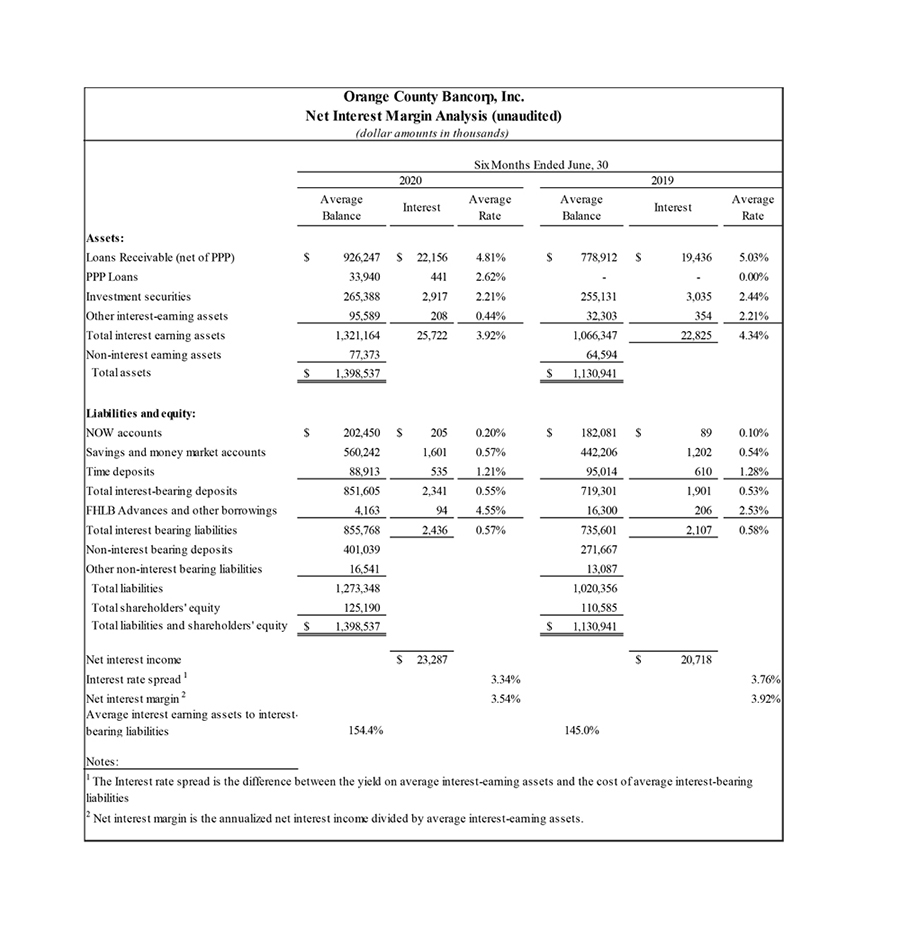

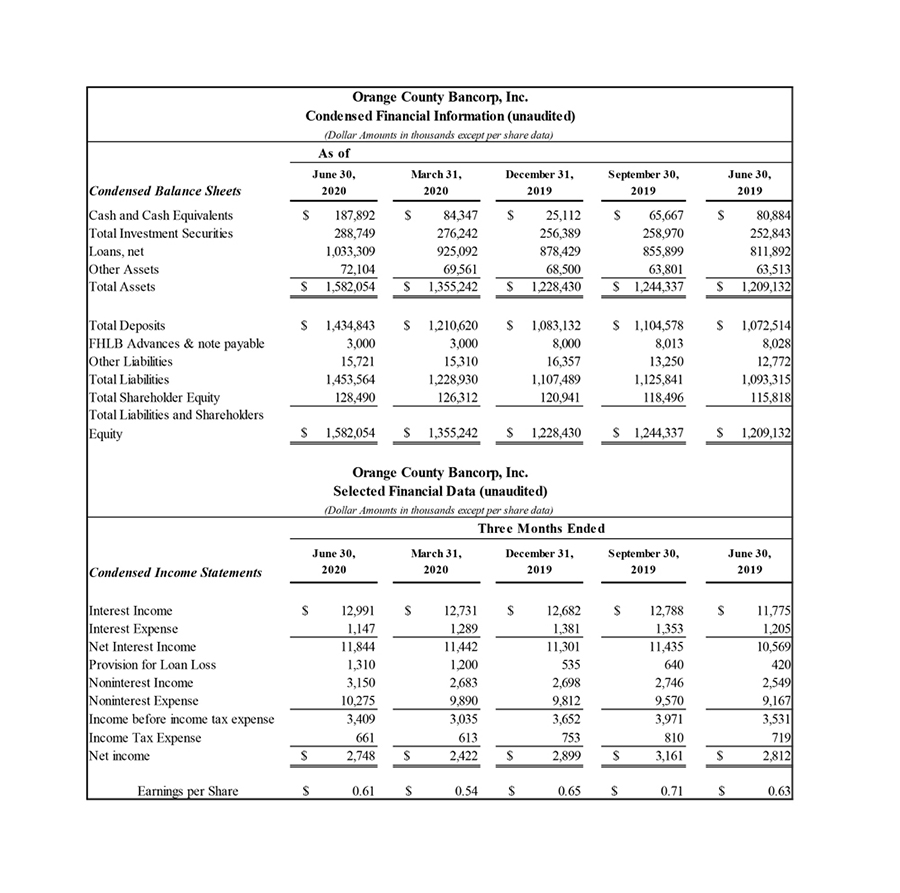

Net interest income for the three months ended June 30, 2020 increased $1.3 million, or 12.1%, to $11.8 million, compared with the three months ended June 30, 2019. The increase is primarily due to a $322.4 million, or 29.7%, increase in average interest earning assets. The growth in average earning assets includes $67.9 million in low rate PPP loans and $94 million in low rate deposits with banks, contributing to a 64 basis point decline in average earning rates. Despite the decline in earning rates, interest revenue increased during the period. Net interest income for the six months ended June 30, 2020 increased $2.6 million, or 12.4%, to $23.3 million, compared with the six months ended June 30, 2019. Average earnings assets grew $254 million, or 23.9%, for the period. The increase in average interest earning assets was driven primarily by a $181.3 million, or 23.3%, increase in average loans outstanding.

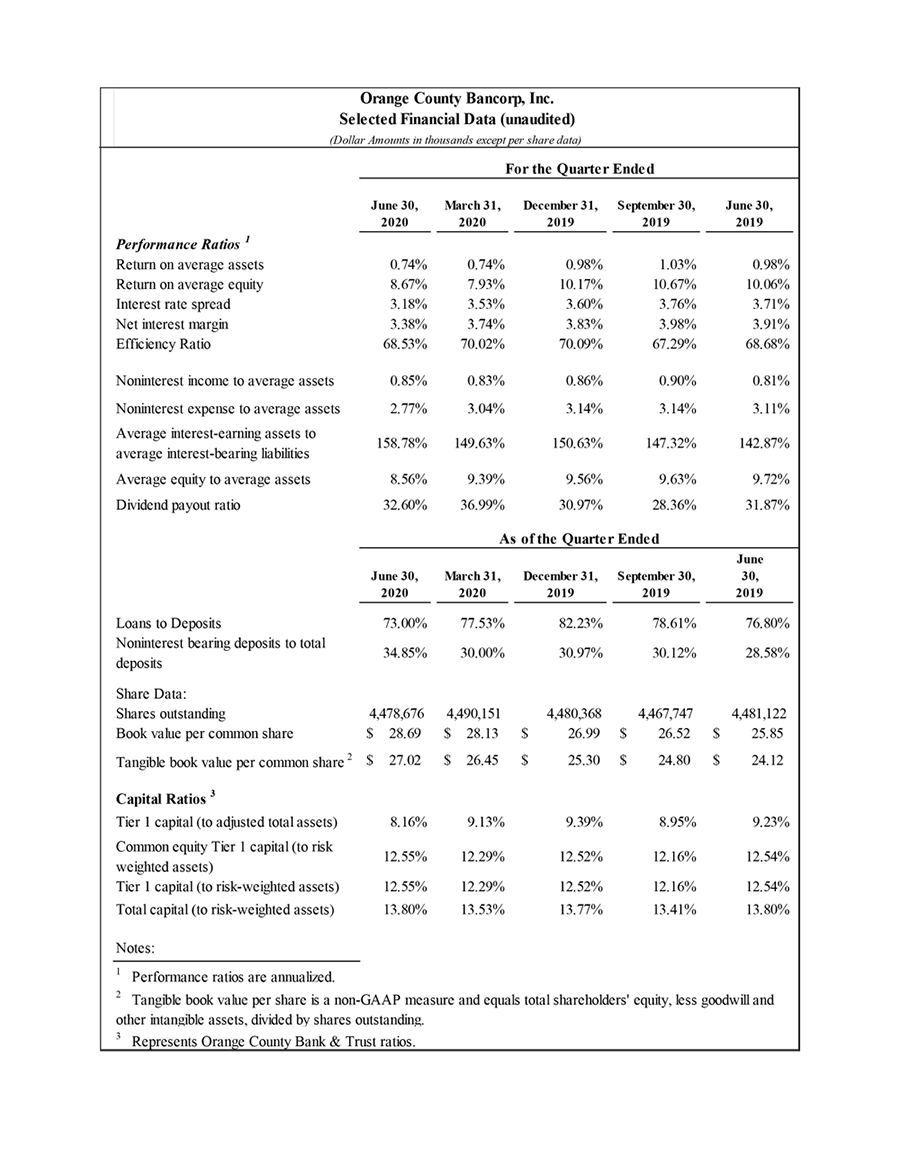

Net interest margin of 3.38% for the three months ended June 30, 2020 represents a 56 basis point, or 15.3%, decline versus 3.94% for the same period last year. The average cost of interest-bearing deposits for the three months ended June 30, 2020 dropped 15 basis points to 0.52%, from 0.67% for the three months ended June 30, 2019, a 22.4% decrease. This drop in funding costs was insufficient to offset the impact of the drop in earnings rates. As explained above, the average asset earning rate was materially influenced by the impact of $67.9 million of new PPP loans with a 1% coupon, combined with a precautionary increase in available funds during this uncertain period. The interest rate picture has changed dramatically over the past 4 months following the Federal Reserve’s move to significantly reduce overnight rates and, through direct bond purchases, lower market rates to unprecedented levels. The feds funds rate is currently between 0% and 0.25% and the 10 year treasury yield is close to 0.65%. The Bank responded by reducing its deposit costs, as evidenced by a 15bp decline in cost of funds compared to the second quarter last year. Cost of funds also benefited from continued strong growth in non-interest bearing demand accounts, with a $191.1 million, or 71.9%, increase to an average of $456.9 million versus the three months ended June 30, 2019.

The outlook for margin includes the benefits of the fees recognized at the time PPP loans are forgiven. The unamortized portion of such fees totaled $3.0 million at June 30, 2020. In addition, as opportunities arise, the Bank plans to prudently build loan balances to redeploy the excess liquidity in order to increase average earning rates.

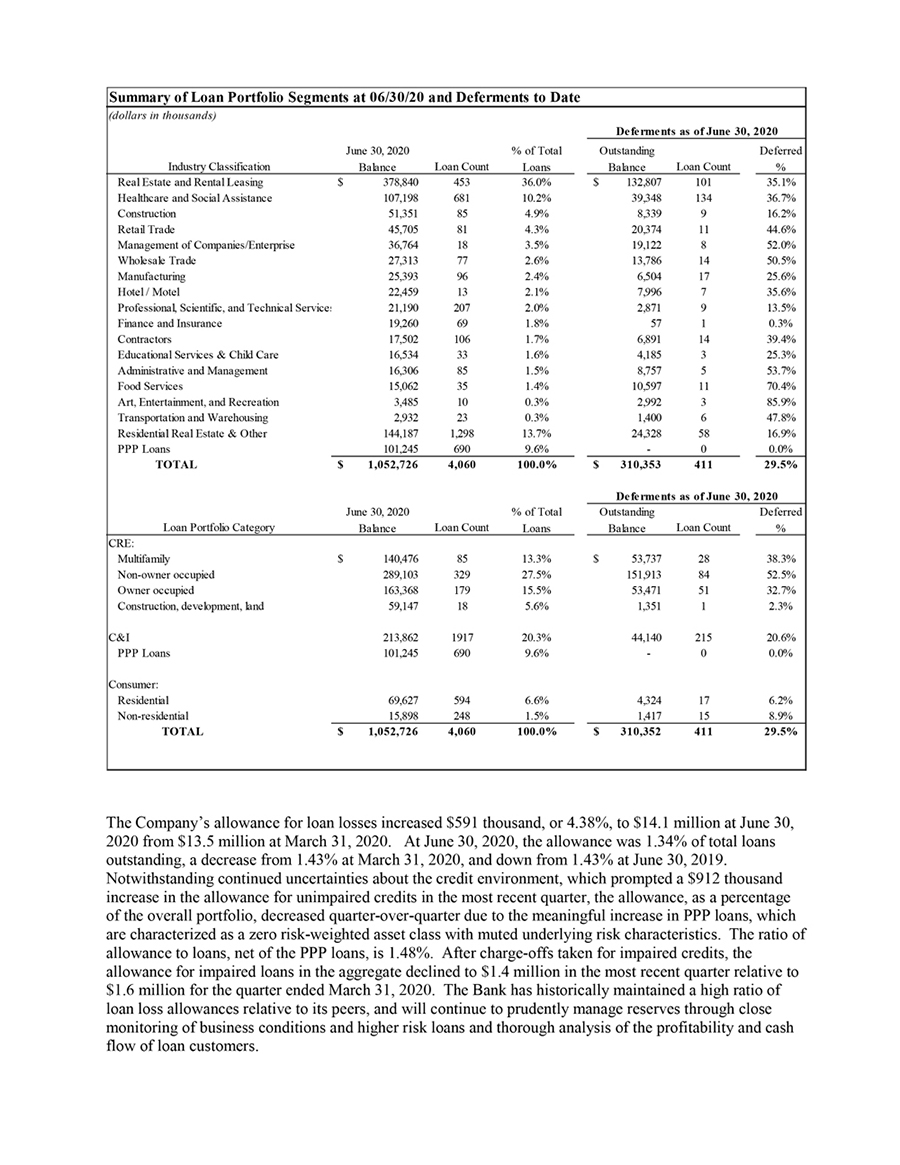

The Bank’s provision for loan losses was $1.3 million for the three months ended June 30, 2020, an increase of $880 thousand, or 209.5%, versus $420 thousand for the three months ended June 30, 2019. For the six months ended June 30, the provision was $2.5 million for 2020 compared to $1.0 million for 2019. The increases were made in response to uncertainty surrounding loan performance due to the COVID-19 related shutdown of various business sectors. While the asset quality of the Bank’s loan portfolio has been improving, these statistics do not reflect the potential stresses facing loans that have been placed on deferred status. Details of deferred loans are shown in the table below. Management believes it is prudent to increase reserves due to this uncertainty. Non-accrual loans, as a percent of total loans, was 0.11% as of June 30, 2020, a 0.08% decrease from the period ended June 30, 2019. See the asset quality section below for additional information.

Non-interest income increased $600 thousand to $2.7 million for the three months ended June 30, 2020, compared to the three months ended June 30, 2019. Non-interest income increased $844 thousand to $5.8 million for the six months ended June 30, 2020 compared to the six months ended June 30, 2019. The improvement is primarily driven by $586 thousand in securities gains realized during the most recent quarter and by improved trust revenue, as detailed in the income statement comparison below.

Non-interest expense increased $1.1 million to $10.3 million, for the three months ended June 30, 2020, compared to the three months ended June 30, 2019. Non-interest expense increased $1.8 million to $20.1 million, for the six months ended June 30, 2020, compared to the six months ended June 30, 2019. The increase versus last year was due primarily to increases in salaries and employee benefits of $830 thousand in the most recent quarter and $1.1 million year-to-date due to growth-related staffing.

The Company’s effective income tax rate for the three and six months ended June 30, 2020 was 19.4% and 19.8%, respectively. For the same periods last year the effective tax rates were 20.4% and 20.0%, respectively.

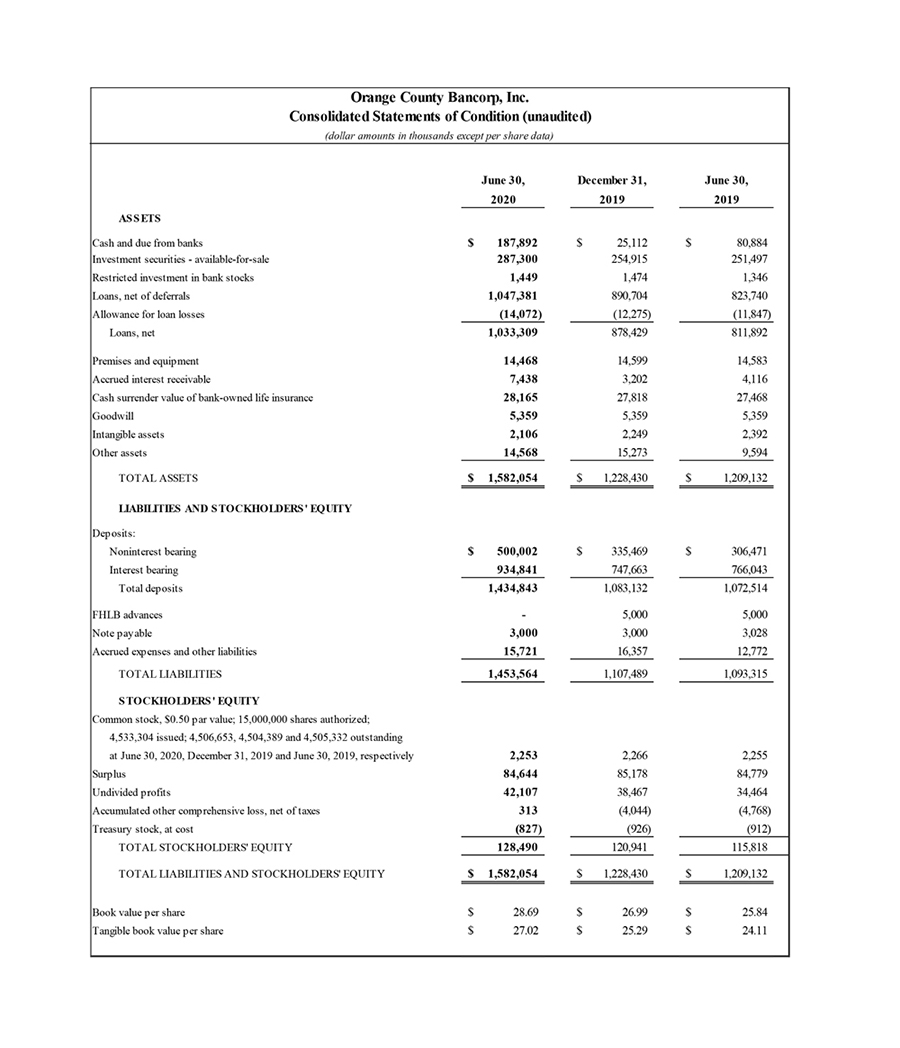

Balance Sheet Summary

Total assets increased $353.6 million, or 28.8%, to $1.58 billion at June 30, 2020 from $1.23 billion at December 31, 2019. This was primarily comprised of increases of $156.7 million in loans, $162.8 million in cash and cash equivalents, and $32.4 million in investment securities, which includes a $5.5 million increase in unrealized gains. The increases in cash and cash equivalents and investment securities was primarily due to increases in deposits, while the increase in loans was the result of $208.5 million of new loan originations and $29.5 million in purchases, partially offset by $78.0 million of net amortization and repayments on our existing portfolio. Draws on credit lines were immaterial during the period.

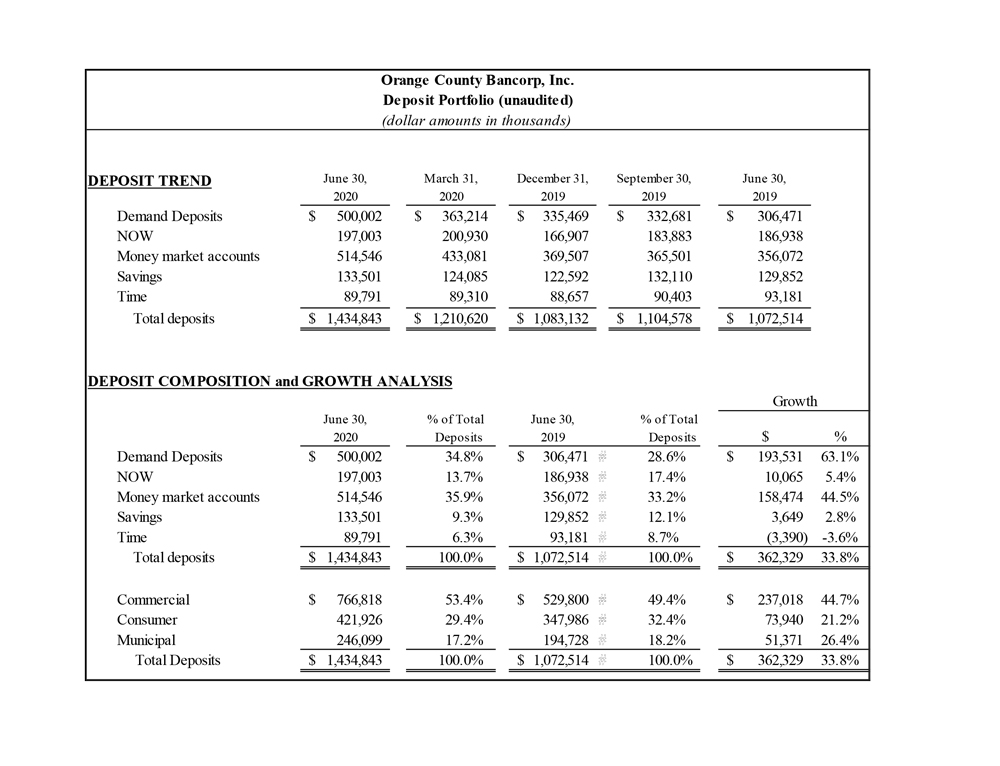

Total liabilities increased $346.1 million, to $1.45 billion, at June 30, 2020 from $1.11 billion at December 31, 2019. This was due to a $351.7 million, or 28.8%, increase in total deposits partially offset by a $5 million reduction in FHLB advances.

Deposit growth continues to increase from non-interest-bearing commercial demand deposits (“DDA”) and NOW accounts. Growth in these deposits was $164.5 million, or 49.0%, from December 31, 2019, consistent with the Bank’s strategy to grow value added business deposits with the support of advanced cash management services. It also includes remaining PPP loan balances. Commercial deposits represented 53.4% of total deposits at June 30, 2020, compared to 46.7% at December 31, 2019. This increase reflects strong response to our company-wide focus on business relationships. Total DDA and NOW balances were 48.6% of total deposits at June 30, 2020.

Total shareholders’ equity increased $7.5 million, or 6.2%, to $128.5 million at June 30, 2020, from $120.9 million at December 31, 2019. This increase was due to a $3.1 million increase in retained earnings and a $4.4 million improvement in the market value of securities available for sale.

At June 30, 2020, the Company’s book value per common share and tangible book value per common share were $28.69 and $27.02, respectively, compared to $26.99 and $25.29, respectively, at December 31, 2019. This represents increases of 6.3% and 6.8%, respectively. At June 30, 2020, the Bank exceeded the “well capitalized” thresholds under applicable regulatory guidelines.

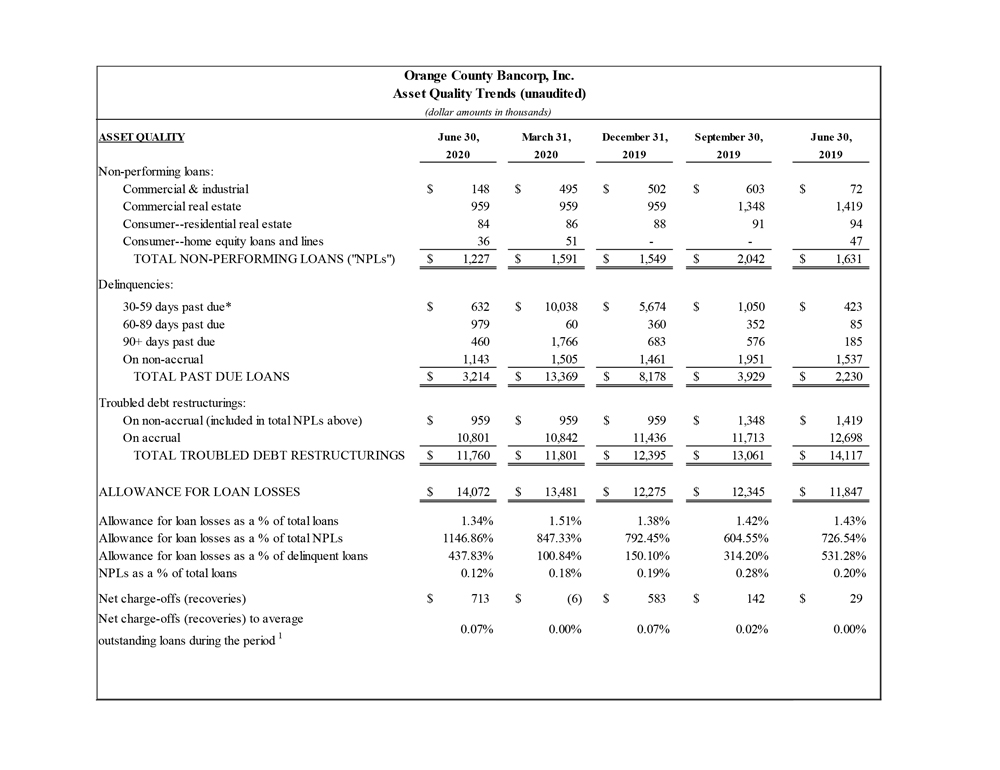

Asset Quality Summary

Non-performing loans decreased $364 thousand, or 22.9%, to $1.2 million at June 30, 2020 from $1.6 million at March 31, 2020, and decreased $322 thousand from $1.5 million at December 31, 2019. Non- performing loans to total loans was 0.12%, 0.18% and 0.19% at June 30, 2020, March 31, 2020 and December 31, 2019, respectively.

Loans classified as substandard or doubtful decreased $2.9 million, or 20.0%, to $11.6 million at June 30, 2020 from $14.5 million at March 31, 2020, and decreased $2.4 million, or 17.1%, from $14.0 million at December 31, 2019. Watch rated loans increased $9.1 million, or 90.0%, to $19.3 million at June 30, 2020 from $10.1 million at March 31, 2020. Delinquencies (inclusive of loans on non-accrual) decreased to $3.2 million, or 0.31%, of total loans at June 30, 2020, from $13.4 million, or 1.42%, of total loans at March 31, 2020, and decreased 5.0 million from $8.2 million, or 0.27%, of total loans at December 31, 2019. The decrease in delinquencies for the most recent quarter, relative to the quarter ended March 31, 2020, was most pronounced in accounts 30-59 days past due, representing a small number of lending relationships that were brought current subsequent to the first quarter through scheduled payments or approved short-term deferments of principal and interest payments. Strong collection efforts throughout the quarter resulted in a 74.0% decrease in loans on accrual status that were more than 90-days past due, relative to the quarter ended March 31, 2020. Loans on non-accrual decreased $362 thousand on a net basis in the most recent quarter as a result of charge-offs processed for two small lending relationships, partially offset by one lending relationship that moved to non-accrual status. The Bank continues to work proactively with customers to manage COVID-19 related forbearance requests, where necessary, with a renewed focus on current and prospective business performance and available liquidity to be utilized for the resumption of loan payments over the near-term.

Management continues to actively evaluate performance trends and industry dynamics across asset classes to assess underlying business and liquidity risks stemming from the economic impact of COVID-19. While the Bank is taking active steps to provide payment relief from debt service through forbearance agreements, the focus has shifted toward the resumption of loan payments as management believes borrowers in need of payment deferrals have largely been accommodated at this time. This relief has been structured as 90-day deferments of principal and interest and effected broadly across the portfolio based on our analysis and direct feedback from customers. Given this deferment window, we are beginning to see many borrowers that requested payment deferrals earlier in the cycle commencing scheduled repayments of their loan obligations. Through July 24, 2020, there were 147 loans with a total principal balance of $157 million that reached the end of their initial 90-day deferment period. About one third of those loans (46 loans with a principal balance of $59.7 million representing 31.3% of loans by number and 38.1% of balances), requested and received approval for an additional 90-day deferment. The other 68.7% of the deferred loans are with borrowers that have the financial wherewithal and business continuity to resume the required debt service obligations at this time. As such, management believes deferments processed through June 30, 2020, as indicated below, represent peak levels across the portfolio:

Trust and Advisory Summary

Trust and Asset Management performed well during the quarter, increasing fee related revenue by $72 thousand, or 3.6%, compared to the same period last year. Year-to-date, these businesses showed a $197 thousand, or 5%, increase in fee revenue compared to the first six months of 2019, despite volatile market performance since the beginning of the year. Close relationships and continuous outreach to our Trust and Asset Management customers provided valued support during this time of uncertainty.

About Orange County Bancorp, Inc.

Orange County Bancorp, Inc. is the parent company of Orange Bank & Trust Company and Hudson Valley Investment Advisors, Inc. Orange Bank & Trust Company is an independent bank that began with the vision of 14 founders over 125 years ago. It has grown through conservative banking practices, ongoing innovation and an unwavering commitment to its community and business clientele to more than $1.5 billion in Total Assets. In recent years, Orange Bank & Trust Company has added branches in Rockland and Westchester Counties, and is in the process of opening a new branch in Nanuet and the Bronx. Hudson Valley Investment Advisors, Inc. is a Registered Investment Advisor in Goshen, NY. It was founded in 1996 and was acquired by the Company in 2012. For more information, visit orangebanktrust.com or hviaonline.com

For further information:

Robert L. Peacock

EVP Chief Financial Officer

Phone: (845) 341-5005